And if you aren’t tracking all your spending and income right now, you’re putting yourself at risk of getting hit with dangerous overdraft fees. Why Should You Balance a Checkbook?īalancing a checkbook is a way to keep up with your transactions. Most people don’t use actual checkbooks for regular transactions these days, but the name still sticks-like “filming” or “taping” a video on your iPhone (even though you’re not using actual film or tape).

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING PATCH#

Learn more about the newest product from Ramsey!Īnd when we say “all your spending,” we mean all your spending-even the bag of Sour Patch Kids you bought at the gas station when you filled up your car yesterday. Basically, it just means you’re making sure the records you’ve kept for all your spending and income match what the bank says on your physical or online statement. They might still use them!Ĭheckbooks are where we get the phrase “balancing a checkbook.” It’s also called reconciling an account. Just ask your parents or grandparents all about checkbooks.

These checkbooks also had small worksheets called registers where you could write down all your transactions going in and out.Ĭrazy, right? The younger folks out there might be surprised to hear this. You could use checks just like cash to buy stuff. What Does It Mean to Balance a Checkbook?īack in the day, before there were things like online banking, most people had these things called checkbooks that contained pieces of paper called checks.

But keeping up with your spending and income is a must, and that’s exactly what balancing a checkbook does! So, let’s break down the what, why and how. Balancing a checking account-aka balancing a checkbook-probably isn’t on your list of fun activities. You may also need to recheck your math to be sure additions and subtractions in your register were made correctly.Let’s be honest. If the numbers do not match you may need to review your transactions to be sure all items were recorded correctly.Compare this amount to the ending total in your checkbook. This will calculate what your checkbook balance should be. Click on the "Calculate Balance" button.These are deposits you have made to your account but do not appear on any bank statement to date. These will be items that were not cleared in step 3. Locate any outstanding deposits and enter them above.These include ATM transactions, Point of Sale (POS) charges, checks, etc. These are withdrawals that you have made but do not appear on any bank statement to date. Locate any outstanding drafts and enter them above.Place a check mark in your checkbook register beside each transaction that appears on the bank statement as having cleared. Compare your bank statement with your check register to see whether all of the transactions you have made have cleared your account.Get the ending balance from your bank statement and enter it in the first field above.

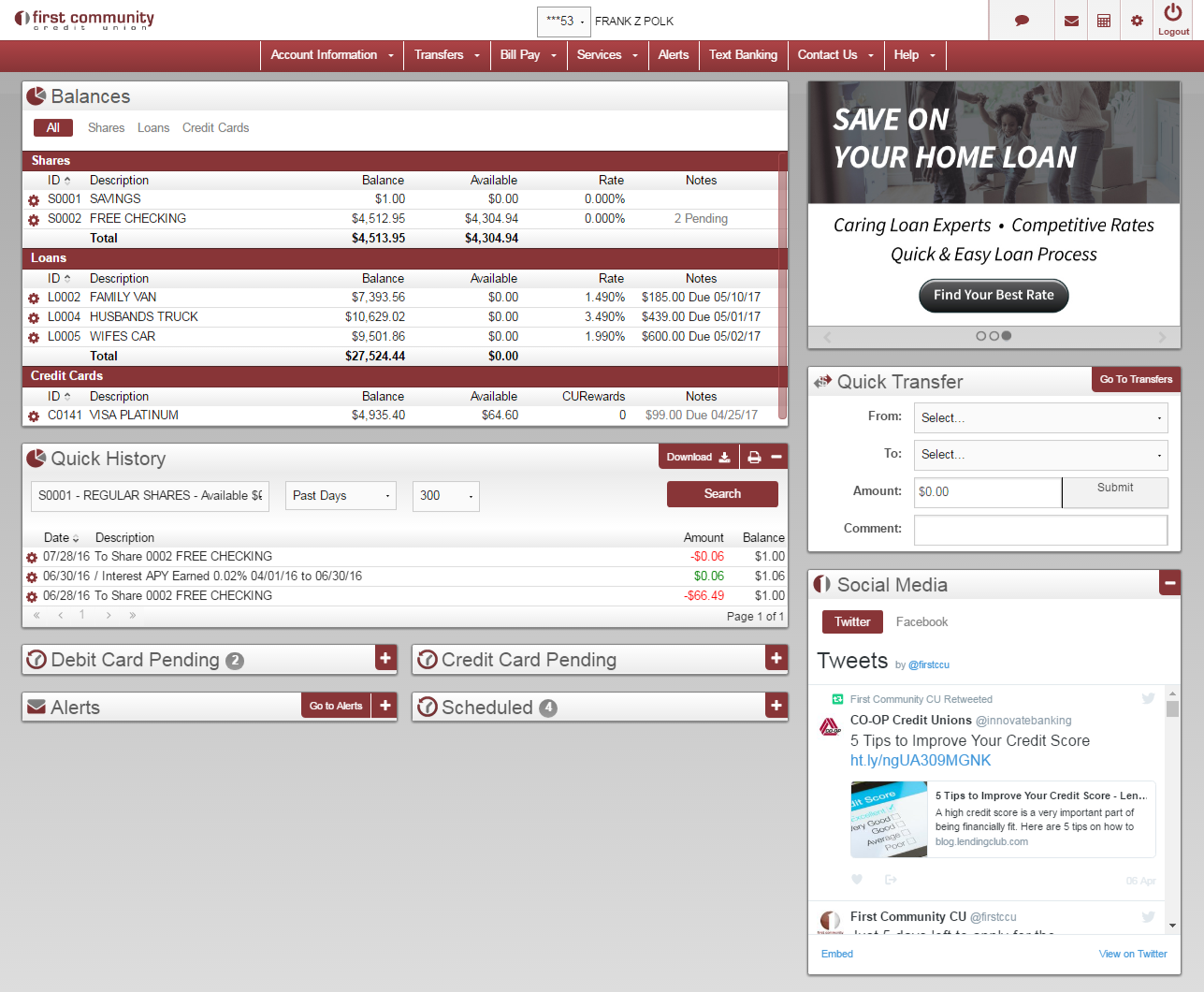

If you do not record service charges or interest in your register you must enter them above.Locate any interest payments, special charges, automatic withdrawals, or automatic deposits and be sure they are all entered into your check register and that your total is updated.The bank records are in the form of your periodic statement. Balancing your checkbook assumes you have been keeping your own record of bank transactions and that you are now reconciling your records with the bank records.See the detailed steps shown below the calculator.īefore using the checkbook balance calculator be sure any interest and other automatic deposits or withdrawals in your bank statement have been included in your checkbook balance. The total you calculate should match the current balance of your checkbook. To balance your bank statement and checkbook you will get the ending balance of your latest bank statement then add or subtract any transactions in your checkbook that have not been included on your latest bank statement. Outstanding Deposits Deposits in your register but not appearing on this statement. Outstanding Drafts Withdrawals in your register but not shown on this statement including ATM transactions, Point of Sale (POS) charges, checks, etc. Interest Enter any interest received on this statement that you Have not calculated into your checkbook register balance.

Service Charges Enter any service charges on this statement that you Bank Statement Balance Enter the ending balance from your current bank statement. Otherwise leave these blank.Ĭheckbook Register Balance Enter the ending balance in your check register. Interest into your checkbook register you should enter them here. * If you did not record bank service charges or Use this calculator to balance your checkbook.

0 kommentar(er)

0 kommentar(er)